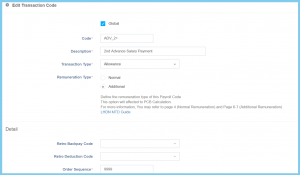

Transaction Code Configuration Option Explaination

| Option | Allowed Values | Description |

|---|---|---|

| Global |

|

If global is enabled, the code will be visible from other companies. If not, it can only be used by its own company. |

| Code | Any alphanumeric | Set a simple and unique transaction code. |

| Description | Any alphanumeric | The description of the code, can also be set as the name of the code. |

| Transaction Type |

|

This is the transaction type to set up its type of uses in payroll for sorting purposes. |

| Remuneration Type |

|

This is the remuneration type for the payroll payment method and the option will affect PCB Calculation. |

| Retro Backpay Code | Setup from Transaction Code | A code selection for retro back pay purposes.

Click here to view setup. |

| Retro Deduction Code | Setup from Transaction Code | A code selection for retro deduction purposes.

Click here to view setup. |

| Order Sequence | Any number | A number to set up the ordering sequence of the code. |

| Option | Allowed Values | Description |

|---|---|---|

| EPF |

|

If enabled, the transaction code is required for EPF. |

| Included into EPF Capping |

|

If enabled, the transaction code is included in the EPF capping. |

| Additional EPF (Employee) |

|

If enabled, the transaction code is required for additonal EPF of employee. |

| Additional EPF (Employer) |

|

If enabled, the transaction code is required for additonal EPF of employer. |

| SOCSO |

|

If enabled, the transaction code is required for SOCSO. |

| EIS |

|

If enabled, the transaction code is required for EIS. |

| Income Tax (PCB) |

|

If enabled, the transaction code may required for PCB. |

| HRD Levy |

|

If enabled, the transaction code is required for HRD Levy. |

| Zakat |

|

If enabled, the transaction code is required for zakat. |

| Pension |

|

If enabled, the transaction code is required for pension. |

| Tax Exempted Category | Selection from tax exempted category | A code selection that allowing certain tax exemption when this code is being used. |

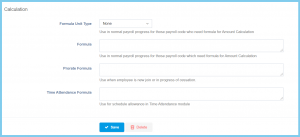

| Option | Allowed Values | Description |

|---|---|---|

| Formula Unit Type |

|

Choose the type of formula unit that is used when the code needs formula to process amount calculation. |

| Formula | Any alphanumeric | Calculation formula that is used when the code needs formula to process amount calculation.

Refer to formula page. |

| Prorate Formula | Any alphanumeric | Calculation formula that is used when the selected employee is new join or in progress of cessation.

Refer to formula page. |

| Time Attendance Formula | Any alphanumeric | Calculation formula that is used for the time attendance schedule allowance.

Refer to formula page. |