1. Edit Employee Profile.

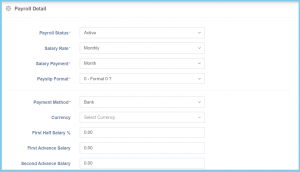

2. Click Payroll.

3. Update the form.

4. Click Save button.

Payroll Configuration Option Explaination

| Option | Allowed Values | Description |

|---|---|---|

| Payroll Status |

|

Select the payroll status from option available. |

| Salary Rate |

|

Select the salary rate from option available. |

| Salary Payment |

|

Select the salary payment method from option available. |

| Payslip Format |

|

Select the payslip format from option available. |

| Payment Method |

|

Select the salary payment method from option available. |

| Currency | Setup from currency code | Select the currency of the salary from option available.

Click here to view setup. |

| First Half Salary% | Any number | Enter the percentage of the first half salary. |

| First Advance Salary | Any number | Enter the amount of first advance salary. |

| Second Advance Salary | Any number | Enter the amount of second advance salary. |

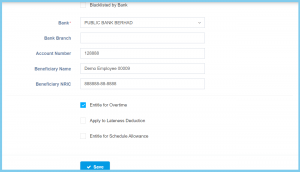

| Option | Allowed Values | Description |

|---|---|---|

| Backlisted by Bank |

|

Ticked when the bank account is blacklisted by bank. |

| Bank | Selection from bank | Select the bank for the bank account. |

| Bank Branch | Any alphanumeric | Enter the bank branch for the bank account. |

| Account Number | Any number | Enter the valid bank account number. |

| Beneficiary Name | Any alphanumeric | Enter the beneficiary name for the bank account. |

| Beneficiary NRIC | Any number | Enter the valid beneficiary IC number. |

| Entitle for Overtime |

|

If enabled, the employee is entitle for overtime. This will affect to time sheet. |

| Apply to Lateness Deduction |

|

If enabled, the lateness deduction will show in time sheet, but will not transfer into payroll. |

| Entitle Schedule Allowance |

|

If enabled, it will entitle allowance according to schedule. This will affect to time sheet. |